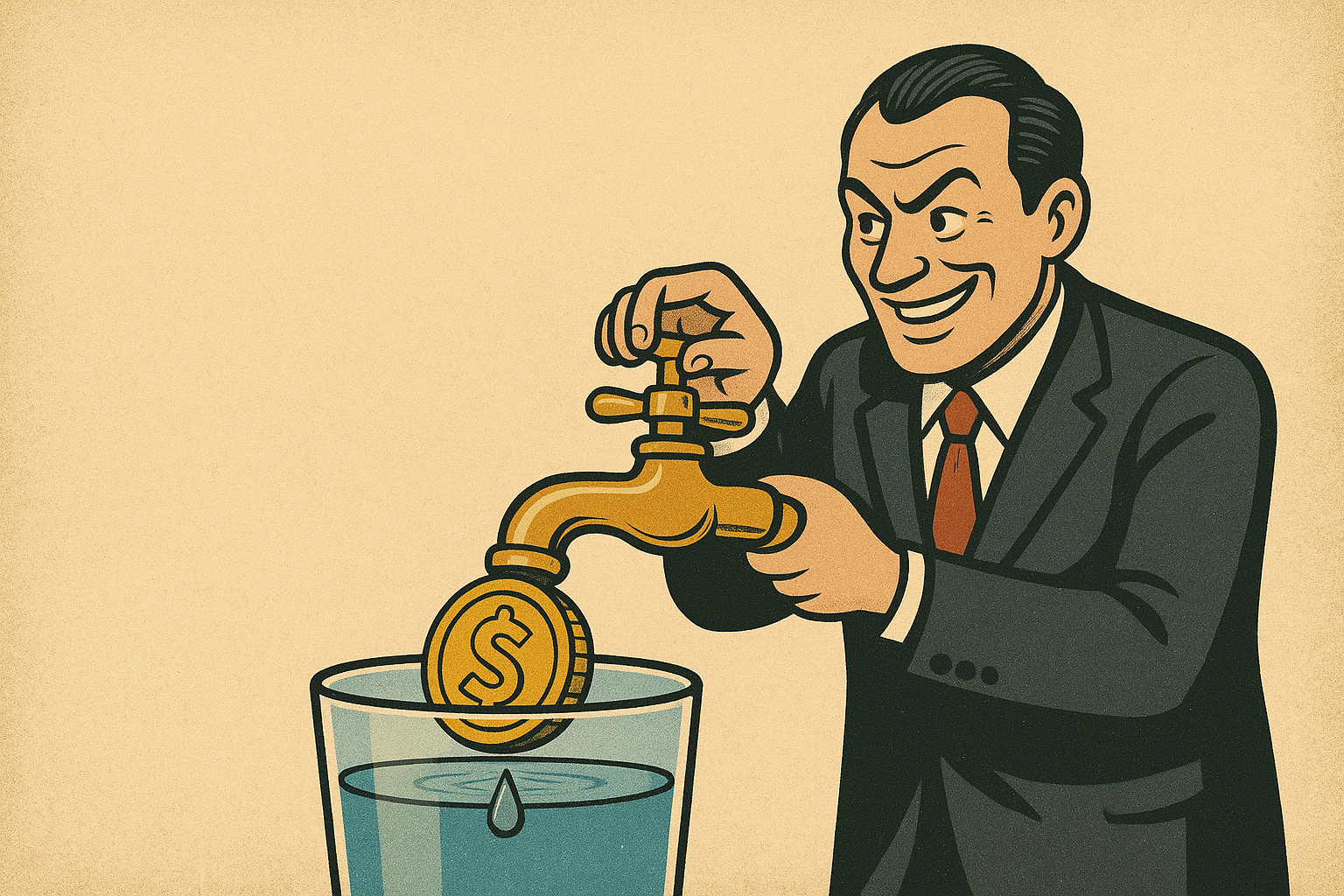

Remember when water used to just… fall from the sky? Cute, right? These days, the world’s most basic necessity is being gift-wrapped and sold back to us, sometimes literally in plastic bottles, other times as futures contracts on Wall Street. Because nothing screams “refreshing” like knowing your next sip has been monetized six ways before it touches your lips.

The right to water, or the right to profit?

Back in 2010, the United Nations bravely declared water a human right. Inspirational, really. Too bad the fine print didn’t include “unless a hedge fund gets there first”. Since then, private investors have rushed in to see how much money they can wring from your kitchen tap.

How to privatize life itself in five easy steps

Step 1: Consolidate utilities

Take two of the biggest water companies on the planet, Veolia and Suez, merge them, and voilà—you’ve got a mega-utility that sets rates from Paris boardrooms while your local council scratches its head over why your bill doubled.

Step 2: Invent water futures

Because if we can trade pork bellies and orange juice, why not bet on droughts? The launch of California’s water futures market means you can now hedge your thirst. Critics call it cruel; Wall Street calls it “liquidity”.

Step 3: Buy farmland just for the water under it

In Arizona’s Cibola Valley, investors bought land only to flip the Colorado River water rights to a suburb hundreds of miles away, Queen Creek. Locals called it a “Pandora’s box”. Investors called it Tuesday.

Step 4: Export the chaos globally

Want to see what happens when privatization meets real people? Look no further than Bolivia’s infamous Cochabamba Water War, where price hikes led to mass protests. Who knew that making the poor pay more for water would cause unrest? Everyone, actually.

Step 5: Build a market, then break it

Australia’s Murray–Darling Basin was supposed to be the Harvard Business School case study of efficient water trading. Instead, it became the Wild West of water markets, complete with allegations of manipulation and Indigenous communities left high and dry.

Inequality is the business model

When water becomes a commodity, three things happen:

-

Bills skyrocket (ask the folks of Cochabamba how fun that was).

-

Rural and Indigenous communities lose out when water is “reallocated” to whoever can pay the most.

-

Transparency disappears because water rights end up in the hands of shell companies and financial funds that treat secrecy as a feature, not a bug. See this investigation for a glimpse into the corporate labyrinth.

But hey, climate change makes it exciting

As droughts worsen, investors view water as a “growth market”. Cape Town nearly hit “Day Zero”, and you can bet someone somewhere was checking whether there’s an ETF for that.

The bottom line

Water is no longer just a human right—it’s an asset class, a revenue stream, a speculative bubble waiting to burst. The elites get dividends; you get a higher bill. At this rate, the next time it rains, don’t be surprised if someone from Wall Street shows up to charge you a “precipitation fee”.